There is a 1% fee to convert and withdraw your crypto to cash in addition to standard network fees. A network fee is necessary in order to have your transaction processed by the decentralized cryptocurrency network.

How much does it cost to withdraw $1000 from Coinbase?

Withdrawal Fees Coinbase charges a network fee for withdrawing currency that varies depending on how much traffic the network is witnessing at the time, and which cryptocurrency you are withdrawing. For Bitcoin, it tends to be $1.00-$5.00, while it’s typically less than $1.00 for other cryptocurrencies.

How do I avoid Coinbase withdrawal fees?

Withdraw in another cryptocurrency Bitcoin has the most expensive transfer fees on Coinbase. One way to reduce transfer fees is to exchange Bitcoin to another cryptocurrency such as Litecoin or Bitcoin Cash.

Can I withdraw all my money from Coinbase?

To cash out your funds, you first need to sell your cryptocurrency for cash, then you can either transfer the funds to your bank or buy more crypto. There’s no limit on the amount of crypto you can sell for cash.

Are fees high on Coinbase?

Trading and transaction fees: 3.5 out of 5 stars Coinbase charges a spread on cryptocurrency sales and purchases. While rates can vary depending on market fluctuations, the company has previously said the fee is about 0.5%. (This fee doesn’t apply for orders placed with Advanced Trade.)

Can I transfer money from my Coinbase wallet to my bank account?

To transfer cash from Coinbase to your linked debit card, bank account, or PayPal account, you first need to sell cryptocurrency to your USD balance. After this, you can cash out the funds.

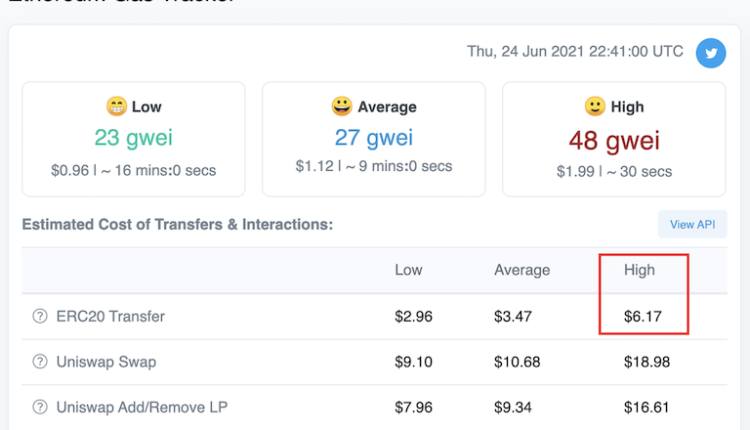

Why is Coinbase wallet fee so high?

Why are Coinbase Wallet Miner Fees so High? The main reason bitcoin mining fees are high is supply and demand. The bitcoin block size is 1MB, meaning that miners can only confirm 1MB of transactions per block (one block every ten minutes).

Is withdrawing from Coinbase easy?

Withdrawing crypto from Coinbase is very simple. It only takes a few steps to complete, but the funds may take anywhere from a few minutes to a few days to arrive in your wallet.

Why did Coinbase charge me 30 dollars?

Coinbase provides a service similar to Paypal. People use it to send and receive money. You are seeing a charge on your statement because someone connected your bank account on our website and used it to purchase bitcoin (a digital currency).

Do I have to pay taxes on Coinbase withdrawals?

If you’re holding crypto, there’s no immediate gain or loss, so the crypto is not taxed. Tax is only incurred when you sell the asset, and you subsequently receive either cash or units of another cryptocurrency: At this point, you have “realized” the gains, and you have a taxable event.

How long until I can cash out on Coinbase?

For US customers, Coinbase uses the ACH bank transfer system for transfers to your bank account. The ACH bank transfer system typically takes 3-5 business days to complete after initiating a sell or withdrawal. Coinbase will deduct the balance from your source of funds and begin the bank transfer immediately.

Who has cheaper fees than Coinbase?

Pionex is the ideal alternative to Coinbase for passive and high-volume investors alike, who would like to invest in the lowest fees possible. As such, Pionex delivers as you get an auto-trading tool that charges a transaction fee of 0.05% only, which is lower than what most exchanges offer.

Are there hidden fees on Coinbase?

Spending with the Coinbase Card has no transaction fees. Coinbase does include a spread in the price to buy or sell cryptocurrencies.

Why did Coinbase charge me 1000?

Coinbase provides a service similar to Paypal. People use it to send and receive money. You are seeing a charge on your statement because someone connected your bank account on our website and used it to purchase bitcoin (a digital currency).

How much USD can you withdraw from Coinbase?

Coinbase Pro account holders have a daily withdrawal limit of $50,000/day. This amount applies across all currencies (for example, you can withdraw up to $50,000 worth of ETH per day). To be considered for higher withdrawal limits, go to your Limits page and select Increase Limits.

How much does it cost to transfer money from Coinbase to bank?

Why do I have to pay a network fee to withdraw? There is a 1% fee to convert and withdraw your crypto to cash in addition to standard network fees. A network fee is necessary in order to have your transaction processed by the decentralized cryptocurrency network.

Why do I have a $100 limit on Coinbase?

Coinbase account limits are determined by an algorithm which takes a variety of factors into account, including but not limited to, account age, location, transaction history, payment method, and verification steps completed. Unfortunately this means that limits can sometimes go down for customers.

Does Coinbase report to IRS?

Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you’ll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes.

What happens when you withdraw from Coinbase?

Since your local currency is stored within your Coinbase account, all buys and sells occur instantly. Cashing out to your bank account via SEPA transfer generally takes 1-2 business days.

How do I avoid Coinbase taxes?

As long as you are holding cryptocurrency as an investment and it isn’t earning any income, you generally don’t owe taxes on cryptocurrency until you sell. You can avoid taxes altogether by not selling any in a given tax year.

How much is crypto taxed after a year?

What are Coinbase fees?

Coinbase charges a flat 1% transaction fee on all cryptocurrency transactions.