The term circulating supply refers to the number of cryptocurrency coins or tokens that are publicly available and circulating in the market. The circulating supply of a cryptocurrency can increase or decrease over time.

How does circulating supply affect crypto?

Cryptocurrency circulating supply is equivalent to outstanding shares of a publicly traded company. This metric counts the number of coins available for trade, as opposed to the number of maximum coin supply. The circulating supply helps us calculate the market capitalization of every coin.

Is a crypto with low circulating supply good?

As a rule of thumb, the fewer coins are available to the general audience, the higher the value of the cryptocurrency becomes. This is especially true when the coin’s maximum supply has been reached: No more mining is possible and the market price reflects supply and demand.

What happens if circulating supply reaches max supply crypto?

The maximum supply of a cryptocurrency refers to the maximum number of coins or tokens that will be ever created. This means that once the maximum supply is reached, there won’t be any new coins mined, minted or produced in any other way.

How does circulating supply affect crypto?

Cryptocurrency circulating supply is equivalent to outstanding shares of a publicly traded company. This metric counts the number of coins available for trade, as opposed to the number of maximum coin supply. The circulating supply helps us calculate the market capitalization of every coin.

Is a high circulating supply good?

The circulating supply is always a percentage of the total supply – the higher the percentage, the better. For example, Bitcoin has a circulating supply of 19 million, which is about 90% of the maximum supply of 21 million.

How important is circulating supply?

Yield. The Circulating Supply metric is of utmost importance within the crypto asset industry and for good reason. It, along with a crypto asset’s per unit price, allows investors to better understand the relative valuation of different assets.

Is it better to buy crypto when its low or high?

Cryptocurrencies like Bitcoin can experience daily (or even hourly) price volatility. As with any kind of investment, volatility may cause uncertainty, fear of missing out, or fear of participating at all. When prices are fluctuating, how do you know when to buy? In an ideal world, it’s simple: buy low, sell high.

Which coin has lowest circulating supply?

What crypto has the lowest supply? D2T has a supply of just 1 billion – and less than 90 million tokens available in its presale – while the next TARO has a low supply of 1.8 billion.

Which crypto has infinite supply?

What does 100 circulating supply mean in crypto?

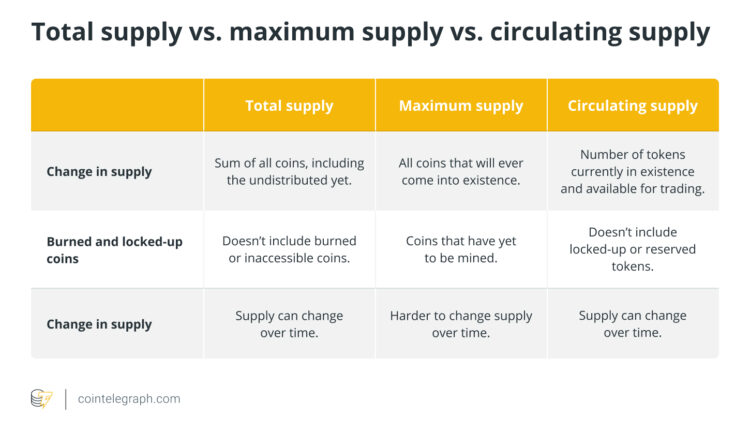

The circulating supply is the number of coins currently available for trade. The total supply is the number of coins that exist on the crypto markets at the present time but are not necessarily in circulation. It does not include coins that may be locked up or inaccessible to the public in some other way.

What happens when circulating supply is low?

Circulating supply is the supply in the law of supply and demand. If it is high and demand is low, prices of respective coins will depreciate. If supply is low and demand is high, then the coin prices will appreciate raising the value of the coins.

What does 100 circulating supply mean in crypto?

The circulating supply is the number of coins currently available for trade. The total supply is the number of coins that exist on the crypto markets at the present time but are not necessarily in circulation. It does not include coins that may be locked up or inaccessible to the public in some other way.

Does circulating supply affect market cap?

For example, if cryptocurrency X has 100,000 coins in global circulation and each coin’s value is $10,000, the overall market cap will be $1,000,000,000, or $1 billion (10,000 x 100,000). The circulating supply may seem low initially, but the high price of the crypto leads to a large market cap.

How does circulating supply affect crypto?

Cryptocurrency circulating supply is equivalent to outstanding shares of a publicly traded company. This metric counts the number of coins available for trade, as opposed to the number of maximum coin supply. The circulating supply helps us calculate the market capitalization of every coin.

Why did Shiba circulating supply go up?

If you’re freaking out about circulating supply on the site increasing, it’s because some people are taking out from what they staked in ShibaSwap, so it goes back into circulation. This number can go up or down, if more people stake then circulating supply goes down again.

How much Shiba is in circulating supply?

The current circulating supply is 549,063,278,876,301.94 SHIB.

What happens when circulating supply is low?

Circulating supply is the supply in the law of supply and demand. If it is high and demand is low, prices of respective coins will depreciate. If supply is low and demand is high, then the coin prices will appreciate raising the value of the coins.

Does circulating supply affect market cap?

For example, if cryptocurrency X has 100,000 coins in global circulation and each coin’s value is $10,000, the overall market cap will be $1,000,000,000, or $1 billion (10,000 x 100,000). The circulating supply may seem low initially, but the high price of the crypto leads to a large market cap.

Will Shiba Inu coin reach $1?

Unfortunately, not even the most optimistic punters believe that’s realistic, and therefore, the only way to reach that price is to reduce supply. It’s unlikely that novelties like the metaverse will result in the 99.99998% reduction in supply Shiba Inu would need to mathematically send the price to $1.

Which coin has limited supply?

The Bitcoin supply is limited to 21 million. In other words, it is deflationary by nature. As a result, not more than 21 million Bitcoins can ever be mined or be in circulation at any given moment. Other tokens, like Ethereum, have a constant flow of new assets added to the ecosystem, which makes them inflationary.