Bitcoin Mining: Everything You Need to Know! What Is Crypto Lending And How Does It Work? Cryptocurrency Vs. Stocks Bitcoin ETFs: What Are They? How To Cash Out Your Crypto Or Bitcoin

In teh ever-evolving world of digital finance, Bitcoin mining has become a hot topic of conversation, with many curious minds eager to learn more about this fascinating process. From understanding crypto lending and the mechanics behind it, to exploring the differences between cryptocurrency and stocks, as well as delving into the world of Bitcoin ETFs, there is a vast array of information to uncover. And for those who have dabbled in the world of crypto and are looking to cash out,there are tricks of the trade to master. So buckle up and get ready to dive deep into the world of Bitcoin mining and beyond!

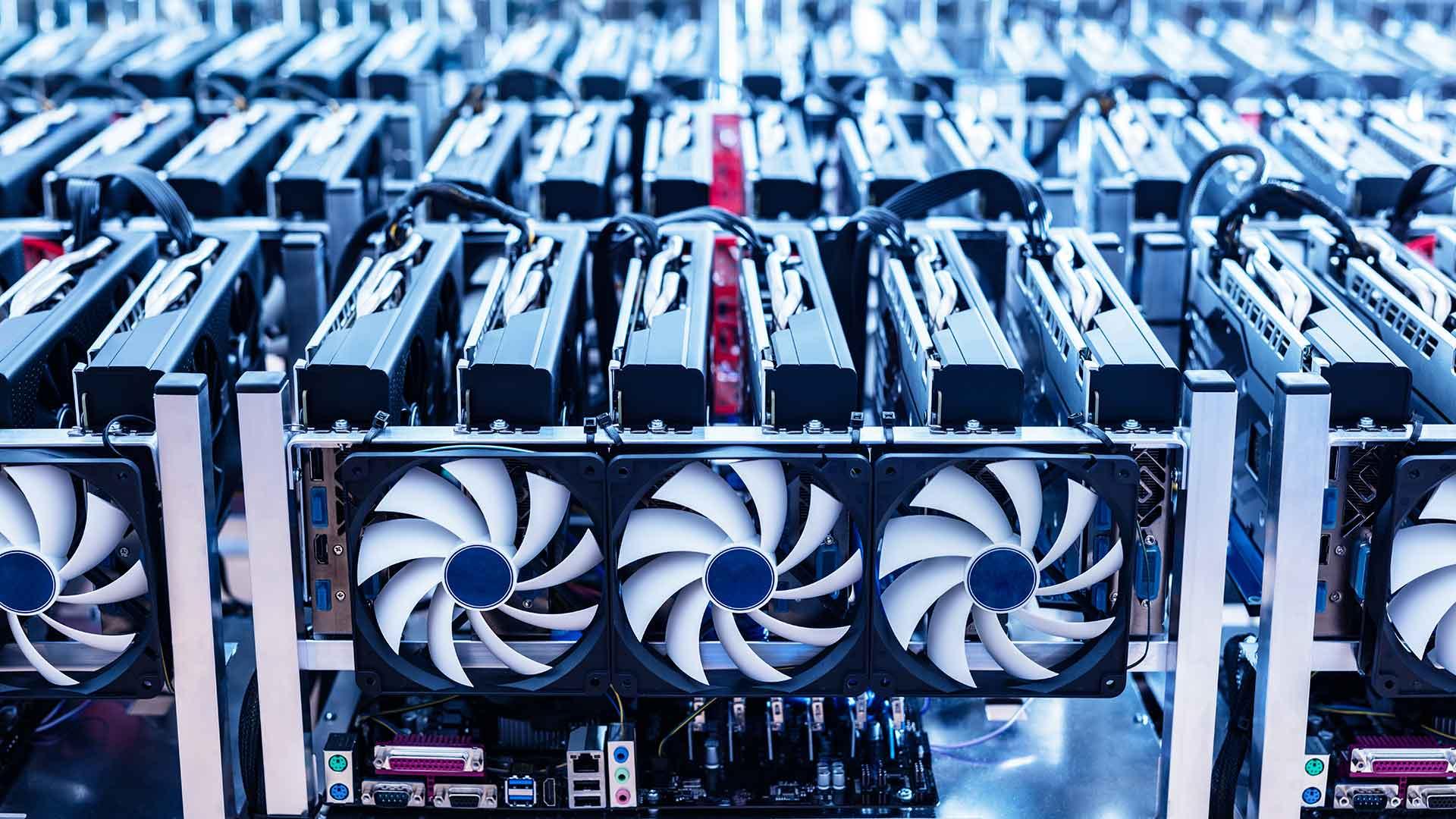

Bitcoin Mining: Everything You Need to Know!

Bitcoin mining is the process of validating transactions and adding them to the public ledger known as the blockchain. Miners use powerful computers to solve complex mathematical puzzles,which in turn verifies transactions and allows new bitcoins to be created. This process requires a significant amount of computational power and energy, making it a competitive and resource-intensive endeavor.

Crypto lending is a growing trend in the world of cryptocurrency,allowing users to lend out their digital assets in exchange for interest. This can be a way for investors to earn passive income on their holdings, while borrowers can access funds without selling their crypto. With the rise of decentralized finance (DeFi) platforms, crypto lending has become more accessible and popular among users looking to diversify their investment strategies. **Crypto lending** offers a unique way for individuals to utilize their crypto assets to generate additional income or access liquidity without having to sell their holdings.

What Is Crypto Lending And How Does It Work?

Crypto lending refers to the practice of lending your cryptocurrencies to others in exchange for interest payments. This allows you to earn passive income on your digital assets without having to actively trade them. How does it work? Essentially,you deposit your cryptocurrency into a lending platform or peer-to-peer lending service. from there, borrowers can request to borrow your crypto assets, and if approved, they will pay interest on the loan until they repay the borrowed amount.

One of the key benefits of crypto lending is that it can provide a way for investors to earn additional income on their crypto holdings. Additionally, crypto lending can be an attractive option for those who believe in the long-term potential of cryptocurrencies but want to generate income meanwhile. It’s important to do your research and choose a reputable lending platform with clear terms and conditions to ensure the safety and security of your assets. Ready to put your crypto assets to work? Consider exploring the world of crypto lending today!

Cryptocurrency Vs. Stocks

When it comes to deciding between investing in cryptocurrencies or stocks, the choice can be overwhelming. While stocks have been around for centuries and are a well-established investment option, the rise of cryptocurrencies in recent years has captured the attention of many investors looking for somthing new and exciting. One of the main differences between the two is that cryptocurrencies are decentralized and not controlled by any central authority, while stocks are issued by companies and traded on centralized exchanges.

For those looking to invest in cryptocurrencies, one popular option is **Bitcoin**, the first and most well-known cryptocurrency.Conversely, stocks offer investors the chance to participate in the ownership and profits of a company. While both cryptocurrencies and stocks have their own unique advantages and disadvantages, it ultimately comes down to personal preference and risk tolerance when deciding where to invest your hard-earned money.

bitcoin ETFs: What Are they?

Bitcoin ETFs are exchange-traded funds that track the price of Bitcoin, allowing investors to buy and sell shares on conventional stock exchanges. These ETFs make it easier for institutional and retail investors to gain exposure to the cryptocurrency market without directly owning Bitcoin. One key advantage of Bitcoin ETFs is that they eliminate the need for investors to deal with the complexities of storing and securing their own Bitcoin holdings.Investing in a Bitcoin ETF can be a strategic way to diversify a portfolio and possibly profit from the volatile nature of the cryptocurrency market. By purchasing shares of a Bitcoin ETF, investors can track the price movements of Bitcoin without needing to navigate the technical hurdles associated with buying and storing the digital asset. Additionally, Bitcoin ETFs provide a level of regulatory oversight and investor protection that may not be available when investing directly in Bitcoin.

How To Cash out Your Crypto Or Bitcoin

When it comes to cashing out your crypto or Bitcoin, there are several methods you can use to turn your digital assets into traditional currency. One popular option is to use a cryptocurrency exchange platform, where you can sell your crypto for fiat money. Simply create an account, verify your identity, and transfer your crypto to the exchange to sell it. once your sale is complete, you can withdraw your funds to your bank account or a payment method of your choice.

- Use a cryptocurrency exchange: Sell your crypto for fiat money on a secure exchange platform.

- Peer-to-peer selling: Connect with buyers directly to sell your crypto without using an exchange.

- Bitcoin ATMs: Find a bitcoin ATM near you to convert your crypto into cash instantly.

Another option is to use peer-to-peer selling platforms, where you can connect with buyers who are interested in purchasing your crypto directly. This method allows you to negotiate your own price and terms, giving you more control over the sale process. Additionally, you can also visit a bitcoin ATM in your area to convert your crypto into cash quickly and conveniently. Simply locate a Bitcoin ATM near you, follow the instructions on the machine, and receive your cash in exchange for your crypto.

The Conclusion

the world of cryptocurrency continues to evolve and present new opportunities for investors and enthusiasts alike. Whether you are interested in Bitcoin mining, exploring the world of crypto lending, comparing cryptocurrencies to traditional stocks, understanding Bitcoin ETFs, or cashing out your earnings, there is always something new to learn and explore in this exciting space. As you continue on your journey through the world of cryptocurrency, be sure to stay informed and make informed decisions to make the most of your investments.Thank you for joining us on this journey of discovery and we hope you find success in your crypto endeavors. Good luck and happy investing!